-- with chinese new tax rates, do you pay more or less? -

- Select city and compute insurance automatically

- Support the new tax rate that passed on June 30, 2011.

- Support new exemption - 3500 RMB

- Support new 7 levels of tax rates

- Tell you how much more or less you pay for tax

- Tell you your how much tax you should pay

- Tell you the net incoming with salary

-- Easy to use --

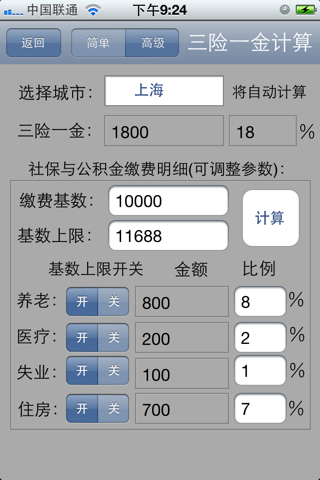

- Just input your salary (月收入) and insurance (三险一金) number, then click compute (计算) button. Thats all.

- If you need compute insurance automatically per city(城市), select city, back(返回), then click compute(计算) 。

- Click the reset (重置) button, it can clear you data to not only protect your privacy but also make it easy to re-input

- It could compute: how much more or less you pay for tax, how much tax you should pay and the net incoming with salary.

- It support salary tax

Note: The computed result data is only used for your reference. Its not used for any legal stuff.

★★★★★中国区免费总排行榜第97名★★★★★

-- 2011.9.1版新税率,算一算你多缴还是少缴个税--

-支持选择城市,自动计算三险一金

-支持2011年6月30号通过的新个税法

-支持新的起征点3500元

-支持新的7级税率

-直接告诉你调整前后多缴还是少缴多少个税

-直观的告诉你调整前后应缴税款金额对比

-直观的告诉你调整前后税后收入金额对比

-支持全国所有省会城市和大城市,自动计算三险一金

-可自定义参数调整,灵活计算三险一金

-- 使用简单 - -

-只需输入月收入和三险一金,然后点击计算就行。

-如需根据城市自动计算三险一金,选择城市,返回,点击计算。

-点击重置,能将你的记录清除既保护你的隐私又方便重新输入

-计算结果包括多缴还是少缴多少个税,调整前后应缴税款和税后收入金额

-支持工资、薪金所得适用个税

免责申明:本软件的计算结果仅供参考,不作为任何法律依据。